Exploring the Fundamentals of Value & Growth Stocks

You don't have to pick only growth or value stocks, but you do need to know about both.

Published May 10, 2024.

Maybe you've just started your stock trading journey and are learning about growth vs. value. Depending on your trading style, you'll want to focus either on value or growth stocks—but that doesn't mean you should exclude either.

A good way to gain clarity before actual stock trading is to start with the basics and learn what value and growth stocks are.

Note: The information in this blog is purely educational and should NOT be considered advice.

What Are Value and Growth Stocks?

Value stocks are shares of companies that appear to trade for less than their intrinsic or book values.

Growth stocks are shares expected to grow at an above-average rate compared to their industry or the overall market.

Value stocks are often associated with companies offering dividends and stable but slower growth prospects. They are attractive for their perceived undervalued status.

Growth stock companies reinvest earnings into the business, so there are no dividends, but there is a potential for rapid expansion. However, the expectation of higher returns usually goes hand in hand with volatility.

Definitions & Key Terminology for Growth and Value Stocks

Earnings Growth

Earnings growth shows how a company's net income, or profits, increase annually. It is an indicator of the company’s financial health and operational efficiency.

This parameter is tied to the company's ability to generate increased profits over time, thanks to:

- Revenue growth

- Cost management

- Operational improvements

It is a key investor metric when assessing a company's future performance and potential profitability.

Revenue Growth

Revenue growth measures the increase in a company's gross sales or revenue over a specific period. It is typically reported annually or quarterly.

This metric shows how effectively a company:

- Expand its business operations and reach

- Captures market share

- Responds to consumer demand

For investors, consistent revenue growth usually indicates a company's competitive advantage and long-term viability in its industry.

Price-To-Earnings (P/E) Ratio

The P/E ratio compares the current share price of a company to its per-share earnings. It is used to evaluate if a stock is over- or under-valued. The P/E ratio is calculated by dividing the stock price by the company's annual earnings per share:

P/E = (Stock price) / (Annual earnings per share)

This offers investors a snapshot of how much they are paying for a dollar of the company's earnings, with an average ratio between 20 and 25.

Price-To-Earnings Growth (PEG) Ratio

Think of the PEG ratio as the boosted P/E ratio, which also considers a company's expected earnings growth rate. It is calculated by dividing the P/E ratio by the annual earnings per share (EPS) growth rate:

PEG ratio = (P/E ratio) / (EPS growth rate)

PEG considers both the current earnings and projected growth; a lower one is considered good, while a higher one is considered bad.

A lower PEG ratio (below 1.0) could mean a stock is undervalued relative to its growth prospects, meaning a potential buying opportunity. Alternatively, higher than 1.0 could indicate that a stock is overvalued and that its price might be higher than its future earnings growth can support.

Remember that these are just starting points, and far more research is needed before you can accurately predict a stock's future price.

Market Capitalization

Market capitalization, or market cap, is the total market value of a company's outstanding shares of stock. It is calculated by multiplying the current share price by the total number of shares outstanding:

Market cap = (Share price) x (Total shares available)

For example, if a company has 10,000 outstanding shares and a share price of $2,000, its total market capitalization would be $20,000,000.

A larger market cap often means more stability. On the other hand, smaller-cap companies could have great growth potential but also come with more risks (such as increased volatility).

A Closer Look at Value Stock Examples

Value stocks have a higher safety margin and typically lower price-to-earnings (P/E) and price-to-book (P/B) ratios.

These stocks typically have higher dividend yields than the market average. Investors are attracted to value stocks because of their potential price appreciation once the market corrects the undervaluation.

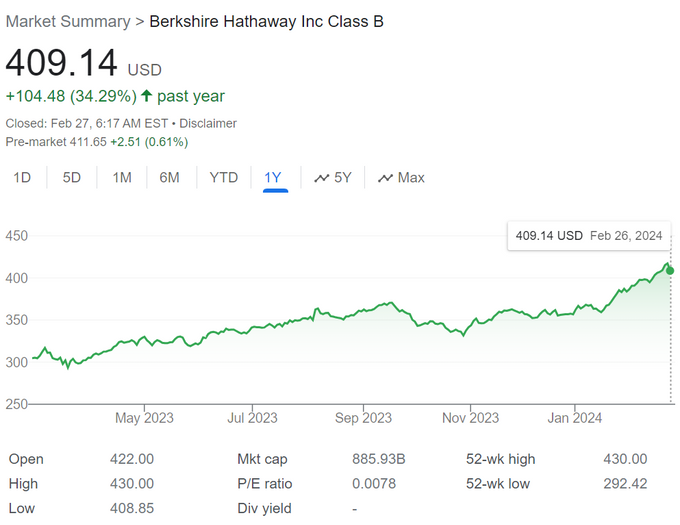

1. Berkshire Hathaway (BRK.A, BRK.B)

Berkshire Hathaway is often cited as a good value stock with a diversified portfolio of undervalued companies or strong fundamentals.

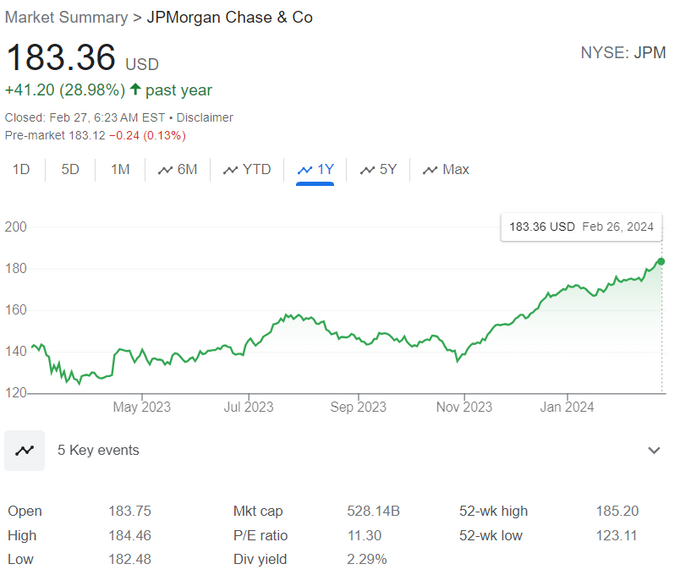

2. JPMorgan Chase & Co. (JPM)

As one of the largest and oldest banks in the United States, JPMorgan usually qualifies as a value stock because of its strong financial health, consistent earnings, and lower valuation metrics relative to its peers.

What Is Value Investing?

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

The basic principle behind value investing is to invest in undervalued companies that have the potential to increase in value over time. This gives investors a margin of safety and the possibility for capital appreciation.

This approach requires:

- Thorough financial analysis to identify undervalued stocks

- Patience to wait for the market to recognize the company's true value

- Discipline to hold onto investments even when they are unfavored by the market

A Closer Look at Growth Stock Examples

The perceived potential of growth stocks is often seen in higher P/E ratios and significant earnings or revenue growth. Investors are usually willing to pay a premium for the anticipated growth.

1. Tesla (TSLA)

Tesla exemplifies rapid expansion and innovation within the electric vehicle market, as its consistent volatility shows.

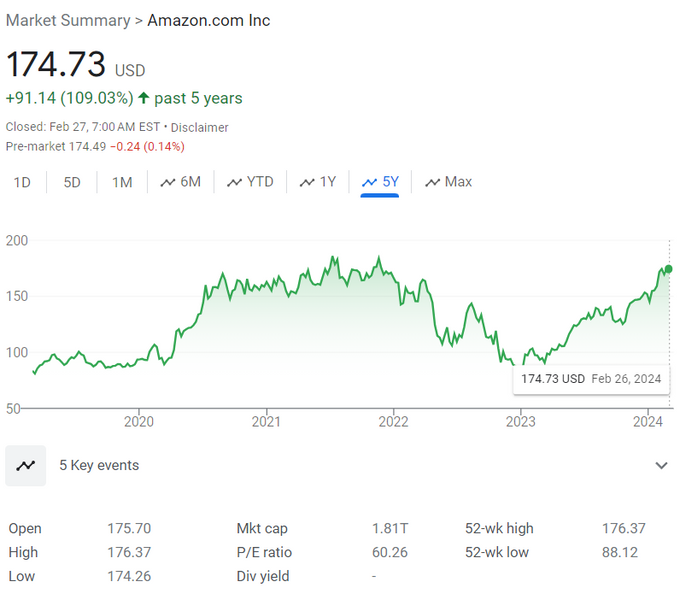

2. Amazon (AMZN)

Amazon is a giant but still shows revenue growth and market expansion in e-commerce and cloud computing.

What Is Growth Investing?

Investors in growth stocks prioritize capital gains over dividends, which is different from value investing. Growth investing focuses on companies expected to grow sales, earnings, and cash flow faster than the market averages.

However, this aggressive growth strategy and high investor expectations also bring about greater risk and volatility in their stock prices. As such, growth stocks are more suitable for investors with a higher risk tolerance and a long-term investment horizon.

Conservative or Aggressive?

Both value and growth stocks have their place in the stock market. Most investors and stock traders tend to have both—and, for example, use value stocks' dividends as a cushion for potential losses while growth stocks develop.

You'll probably consider one more than the other, depending on your preferences. Once you've determined which strategy you're comfortable with, it's time to start researching specific stock markets and sectors.

» Learn about opening your account with Fortrade Invest.