For Long-term Investments

-

Growth potential

Before considering acquiring shares in a company, do your research first - understand what that company does, its business model, competitive edge, and historical performance.

After the research, if you believe the company will grow in value in the long term, then the company’s stock might be a good one to acquire. -

It pays dividends

Some stocks pay dividends. Dividends are the profits the company distributes to its shareholders, usually on a quarterly basis.

Dividend stocks offer the possibility of not only providing additional income, but they can also act as a reliable backup income source during times of market volatility when you need money.

Alternatively, if you don't immediately need the dividend payments, you can reinvest them back into the stock. This reinvestment can further enhance your investment returns. -

You want to vote on corporate matters

Often shareholders are entitled to vote on important matters, such as electing a new board of directors or shifting corporate financial goals. Voting rights allow shareholders to influence the success of their investment. So, if you believe in a company and want to take part in steering the ship, acquire its stock and become its shareholder.

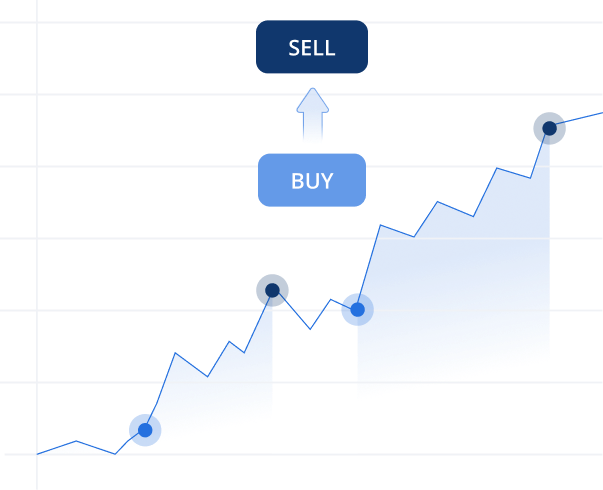

For Short-term Investments

It's important to understand that while short-term investing offers the potential for higher returns it comes with increased risk. This high–risk strategy involves capitalizing on opportunities over brief periods, ranging from seconds to a week.

If you think the stock price will change soon, you can acquire the stock and cash in on that volatility. However, bear in mind the risks involved in trading.

The Bottom Line

Stocks can be potential investments for individual investors seeking both liquidity and stability to grow their wealth. The reasons to consider investing in a stock may vary, it's only up to each investor to do their homework.