Beginners' Guide to Real Estate Sector Stocks

Real estate sector stocks offer diverse possibilities, with some attractive advantages.

Updated June 24, 2024.

Real estate stocks, especially those in REITs, could be a potential improvement to your portfolio, mixing steady income with the chance for growth. Although they have specific advantages, some real estate stocks can be very volatile.

Note: The information in this blog is purely educational and should NOT be considered advice.

What Are Real Estate Sector Stocks?

The real estate sector is a big part of the stock market, comprising companies that own, operate, or finance properties for income.

This sector is stable because of dividends (usually from rent), with the potential for value growth. Real estate stocks attract investors seeking regular income and protection against inflation.

The nature of real estate investments, the growth potential, and historical resilience in different economies make them appealing. Plus, thanks to diversification opportunities, they typically behave differently from more volatile sectors like tech or energy.

What Are REITs?

REITs, or real estate investment trusts, offer investors a way to create a real estate portfolio similar to those in other sectors through stocks.

Unlike typical stocks, REITs have unique rules. By law, they must pay investors at least 90% of their income as dividends, which often results in higher yields.

The REITs' and other real estate stocks' performance is influenced by more than just the company's profits, such as:

- The economy

- Interest rates

- The real estate market as a whole

Real Estate Stocks Sub-Industries

Real estate sub-industries provide varied investment options across the property market. This helps investors spread risk and find growth opportunities in different economic climates.

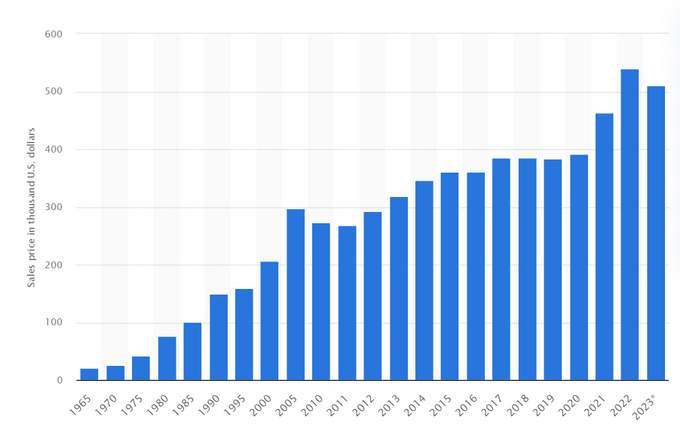

Residential Real Estate

This sub-industry is usually the most familiar form of real estate, involving housing for individuals, families, or groups of people.

Examples include:

- AvalonBay Communities (AVB)

- Equity Residential (EQR)

- Mid-America Apartment Communities (MAA)

This tends to be quite stable, as people always need housing, but it can be sensitive to interest rate changes.

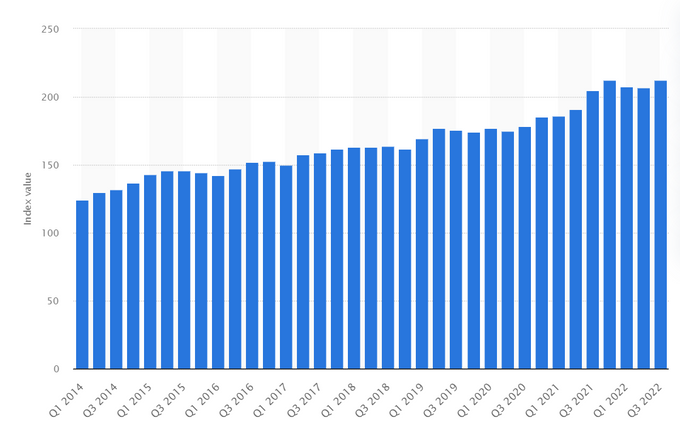

Commercial Real Estate

Unlike residential properties, commercial real estate includes office buildings, warehouses, and other spaces mainly used for businesses.

Examples include:

- Boston Properties (BXP)

- Vornado Realty Trust (VNO)

- SL Green Realty (SLG)

Commercial real estate often performs well during economic expansions. It works best in markets with increased business activity. During a recession, demand may decrease.

Retail Real Estate

Retail real estate comprises properties that market and sell consumer goods and services, such as shopping centres and malls.

Examples include:

- Simon Property Group (SPG)

- Macerich (MAC)

- Kimco Realty (KIM)

With the rise of e-commerce, this sub-sector has faced challenges. However, prime locations continue to hold value.

Industrial Real Estate

This involves properties used solely for industrial purposes, such as factories, logistics, and distribution centers.

Examples are:

- Prologis (PLD)

- Duke Realty Corporation (DRE)

- Rexford Industrial Realty (REXR)

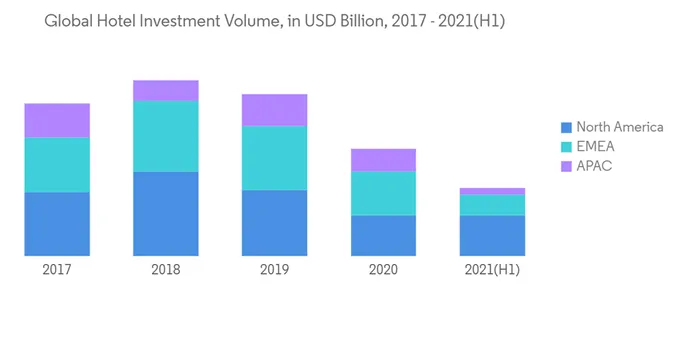

Hospitality Real Estate

It covers properties that provide services and facilities, such as hotels, resorts, and conference centres.

Popular companies in the hospitality sub-sector are:

- Host Hotels & Resorts (HST)

- Park Hotels & Resorts (PK)

- Ryman Hospitality Properties (RHP)

This type of real estate can be highly cyclical, with performance closely tied to consumer confidence and travel trends. It is sometimes seen as the most volatile type of real estate.

Definitions & Key Indicators

Key Players in the Real Estate Sector

The real estate industry is supported by different companies, each playing a role in the market's dynamics, from managing properties to developing projects and facilitating transactions:

Property management: These companies take care of everyday tasks for real estate properties, like upkeep, leasing, and dealing with tenants.

Real estate development: These firms handle everything from buying land to building properties. They focus on the entire process, including planning, market research, and ensuring the project is profitable when finished.

Real estate brokerage: Brokerage firms help buy, sell, and rent properties. They use their local market knowledge and connections to make real estate transactions easier and more efficient for everyone involved.

Net Operating Income (NOI)

NOI is a key calculation for assessing the profitability of real estate investments that produce income. It's determined by subtracting the property's operating expenses from its total income:

NOI (net operating income) = Total income - operating expenses

Calculating NOI is straightforward. For instance, if your property generates $36,000 in revenue and has $15,000 in operating expenses, your NOI would be $21,000.

Cap Rate

The cap rate is a metric used to estimate the potential return on a real estate investment. The formula is:

Cap rate = Property's net operating income (NOI) / Current market value

For example, a property worth $10 million generating $500,000 of NOI would have a cap rate of 5%.

Cash-On-Cash Return

Cash-on-cash return is a common measure in real estate deals, showing the cash income earned relative to the cash invested in a property:

Cash-on-cash return = Annual cash flow / Initial cash investment × 100%

If, for example, you’ve bought a $500,000 property and you charge $3,000 per month for rent, you’re making $36,000 annually, with a cash-on-cash return of 7.2%.

Real Estate Cycles

Real estate cycles are the repeating patterns in real estate markets that mirror the economy's general health. These cycles include phases such as recovery, expansion, hypersupply, and recession.

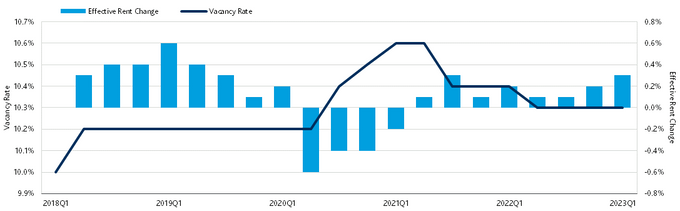

Rental Income

Rental income is the money property owners earn from tenants who use their property. It's a main revenue source for most real estate investments, especially residential and commercial properties.

Laying the Foundation for a Real Estate Portfolio

After diving into real estate stocks, it's clear they offer a variety of choices for your investment goals. Whether you're interested in the reliable nature of homes or the exciting possibilities in commercial spaces, there's something for everyone.

However, before you decide if you should add real estate stocks to your portfolio, ensure that you conduct extensive research and have a risk management strategy in place. These are the best safeguards for any stock, especially in volatile markets.

» Learn more about opening a trading account with Fortrade Invest